QUALITY MAGAZINE APRIL 1991

The test and measurement industry is no exception.

BY ALAN N. FRANKEL

A regional environmental analytical laboratory was bidding on a significant piece of new business. The laboratory already had three gas chromatograph systems; however, this job would require a fourth. The director had used the annual capital budget on equipment to upgrade the laboratory’s high-technology equipment to maintain a competitive edge in its markets. There were no funds budgeted for the additional gas chromatograph. The new business represented $70,000 in new revenues.

In doing his research, the director asked his vendor for cost estimates to purchase the gas chromatograph. The supplier, as part of his regular customer service, suggested that leasing might be a possible option. After learning about the advantages, the director decided to lease the equipment—and got the new business.

When it’s not a capital budget idea, leasing is a very attractive alternative. Capital expenditure budgets generally are planned months, in some cases years, in advance. Yet opportunities for new business can materialize overnight. These opportunities may require specialized testing equipment to support a new customer or the expansion of existing business.

To pass on a new business opportunity because the needed equipment is not included in the capital budget isn’t good business.

In the test and measurement industry, this situation is not very unusual, particularly for environmental laboratories. While the US market for test and measurement equipment is projected to grow slightly in 1991, the possible exceptions are markets riding current technology trends, such as environmental testing. There are a significant number of “overnight” opportunities that develop in these markets.

As a result of an overall slowdown in the electronics industry, buying power, production, inventories, and export growth have been reduced. It follows that acquiring electronic equipment may be more difficult because of increased competition for limited funds.

The ongoing struggle between priority needs and existing cash has caused a major movement toward equipment leasing as a financing alternative. Equipment leasing is a $100 billion a year industry, and seven out of 10 American firms use leasing as a financial management tool, according to a recent Gallup study commissioned by the American Association of Equipment Lessors.

Stefan Wawzyniecki, laboratory director for Fuss Environmental Inc., was faced with a new business opportunity, limited cash, and no budgeted capital funds. After conducting research, he authorized leasing a Tremetrics analytical gas chromatograph. This decision helped secure the new business.

Fuss Environmental Inc. is a regional environmental testing laboratory located in Manchester, CT. Founded in 1974, the company is typical of most medium-size analytical labs. Recognized by Connecticut as a public health laboratory, Fuss provides most analytical lab services for monitoring water and solid waste effluent. The laboratory currently has four gas chromatograph systems, two atomic absorption units, a gas chromatograph/mass spectrometer, a TOC/TOX analyzer and an UV-vis spectrometer.

Wawzynecki had spent his capital budget on purchasing three gas chromatographs and the atomic absorption unit when the new business opportunity surfaced. The director needed an additional gas chromatograph, but he did not have the cash flow or capital funds to purchase the equipment.

Donald A. Curley of Bay State Analytical Products, Inc., a manufacturer’s representative for Tremetrics, had dealt with Fuss previously and sold Fuss the three gas chromatograph systems already in place. Knowing Wawzynecki’s situation, Curley suggested he consider leasing the $40,000 gas chromatograph.

Knowing that Wawzynecki needed the equipment but did not have the cash flow to purchase it, Curley recommended that the lab director talk to Copelco Leasing Corp., a leasing company used by a number of Tremetrics manufacturers’ representatives. Curley felt comfortable with Copelco, because the leasing company knows the equipment and the industry. He and Wawzynecki did not have to waste time explaining—as is the case with most banks, which “generally don’t know a gas chromatograph from a rocket.”

According to Curley, the environmental testing area is a hot market right now. His typical sales in this market range from $30,000 to $40,000 for gas chromatographs, mass spectrometers, and atomic absorption units. In some cases, the equipment costs can be well over a $100,000.

Although Curley prefers selling direct to his customers, he is a supporter of leasing when it’s good for them. And it can be very good. An analytical lab running 10 to 15 samples a day, charging $100 to $150 per sample, can generate weekly revenues of $5,000 to $11,250, easily supporting a monthly lease that might range between $500 and $800.

Copelco Leasing Corp. worked with Fuss Environmental to structure a lease that was flexible and supported Wawzynecki’s needs. The arrangements turned out to be a three-year lease with a three-month deferred payment. Fuss was up and running before the first lease payment was due.

Fuss Environmental wanted the new business and needed the additional gas chromatographs to support the growth. Wawzynecki very quickly learned about leasing.

Leasing is a good option

The complicated problem of capital financing, for both the acquisition of high-technology equipment and the modernization of existing assets, is not unique to the test and measurement industry. In fact, the age-old struggle to preserve cash while keeping pace with competitors continues to be a concern for companies that have explored most available financing options and discovered very few innovative or creative financing alternatives.

The primary goal of most vanguard companies is to gain the use of essential equipment at the least possible cost. Actual ownership is not imperative, especially if the asset involved is a big-ticket item with the potential for a relatively short life expectancy. Equipment that quickly diminishes in value and has a high risk for obsolescence presents the greatest challenge of all to cost-conscious managers.

The lease-buy decision certainly is complex. But equipment leasing is a sophisticated tool that offers many unique advantages over other forms of financing. Leasing may not be the answer for all companies in all situations, but laboratory directors often can turn to leasing as a financing option and possibly get new business or expand existing business.

One of the primary benefits of leasing is that the equipment is not capitalized, meaning that the monthly payments are considered as expense items on the operating budget. Since the asset does not appear on the balance sheet, neither does the corresponding liability. This enables companies to avoid budgetary restrictions and the need to restructure the capital budget.

Leasing preserves capital by acting as an alternative source of funds, specifically designed as a term accommodation. Leasing is intended to augment, not replace, existing capital sources. A lease provides equipment funding while allowing traditional lenders to provide working capital.

Equipment leasing provides 100 percent financing; most other forms of financing require an equity contribution of 10 to 20 percent. This requirement may be an impossible burden, especially for a new venture or those firms built with limited cash flow.

The leasing credit process is flexible and may help circumvent the restrictive provisions of typical loan documents.

One complaint often heard about traditional lenders is the degree to which they usurp the company’s decision-making process. Restrictive covenants may require specific financial ratios to be maintained, certain levels of working capital to be on hand, or a host of other considerations. These often are accompanied by demands for detailed and frequent financial reporting.

By contrast, most equipment leases contain a brief paragraph usually headed “Quiet enjoyment.” In essence: Perform under the terms of the lease, and the lessor will permit possession and uninterrupted use of the equipment.

The premises upon which banks and leasing companies operate are different. Banks, insurance companies, and other sources are primarily balance sheet lenders. In most cases, they give little weight to the equipment securing their loans. Leasing companies, on the other hand, look to the remarketability of the equipment as security.

This difference in philosophies accounts, in part, for other benefits found in a leasing arrangement. One of these is term flexibility.

It is not unusual for a leasing company to write a lease of 3 to 10 years on certain equipment; high-technology equipment items, such as mass spectrometers, atomic absorption units, and coordinate measuring machines, are typical. This is a benefit that may or may not be attractive to every company.

A common element of high-technology equipment leases is the provision for deferred payments that may be as long as six months. This allows for the installation and operation of the equipment so that payments can be made from the revenue generated from its use.

Similarly, leases may be structured with lower initial payments, a higher amount during the years of peak utilization, and a reduced amount toward the end of the contract, when replacement or upgrade decisions are being made and the equipment is experiencing more downtime.

Some manufacturers require progress payments before the installation of the equipment. Many leasing companies will fund these interim payments, charging only interest on the funds in use before the lease commences. Also, it may be possible to have the accrued interest rolled into the lease itself so that no payments are due until after the equipment is installed and operating.

Most organizations agree that the number one perceived benefit of equipment leasing is as a hedge against technological obsolescence. Leasing companies, in assessing the future residual value of the equipment, reflect the degree of assumed technological obsolescence in the lessee’s payments. Leasing aids in the avoidance of obsolescence, because the equipment is not owned by the lessee. When the lease term is complete, the lessor remarkets the equipment, leaving the lessee free to obtain the latest generation.

With test and measurement equipment, obsolescence may be technical or practical. Whether the equipment continues to serve a useful function is not always the determining factor. Whatever the definition of obsolete, however, leasing arrangements can be structured to accommodate it.

For example, leases can be structured to allow for upgrading equipment after a certain period of time, simply by adjusting the monthly terms. This is increasingly popular as high-technology test and measurement equipment becomes more modular and thus more easily upgraded.

Lease terms can be structured to fit the needs of various companies. For example, one company may consider a piece of equipment with a 15-year useful life to be obsolete after only 3 years. This may be true for a company that wants to be perceived as being on the cutting edge of technology. It may structure a lease to allow for disposal of the equipment long before it becomes mechanically useless.

The variations of equipment leases are limited usually only by the needs of the lessee. Generally, leasing companies will try to honor any reasonable request.

ALAN N. FRANKEL is president and chief operating officer of Copelco Leasing Corp. and vice president of Copelco Financial Services Group, Inc., its parent company.

Leasing NDT Instruments

BY JOHN J. KENDRICK

Magnetic Analysis Corp. (MAC), Mount Vernon, NY, has been a developer of nondestructive testing techniques and instruments for more than half a century.

Founded in 1928 to develop methods of testing carbon steel bars for defects using electromagnetic principles, MAC has grown to where it now tests magnetic and nonmagnetic metal products for a variety of defects and metallurgical and physical characteristics.

Instruments have been developed using electromagnetic, eddy current, flux leakage, and ultrasonic techniques for inspecting products ranging from 400 mm diameter tubing to 1 mm diameter ball bearings. Conditions ranging from seams, laps, cracks, and holes to inadequate heat treatment and alloy variations can be detected reliably and economically with these methods.

Most of MAC's customers lease their equipment, enabling them to easily upgrade the instruments as new developments are made available. The lease arrangement also provides servicing in the plant as needed and regular calibration checks for continuity of operation.

Magnetic analysis equipment leased by MAC includes a line of rotary probe instruments for the detection of surface defects in magnetic and nonmagnetic wire, rod, and bars. Using eddy current technology, these instruments use a rotating, focused null-type probe for detecting defects such as seams, laps, and cracks. Specialized applications include installations where the part under test is rotated past a stationary probe.

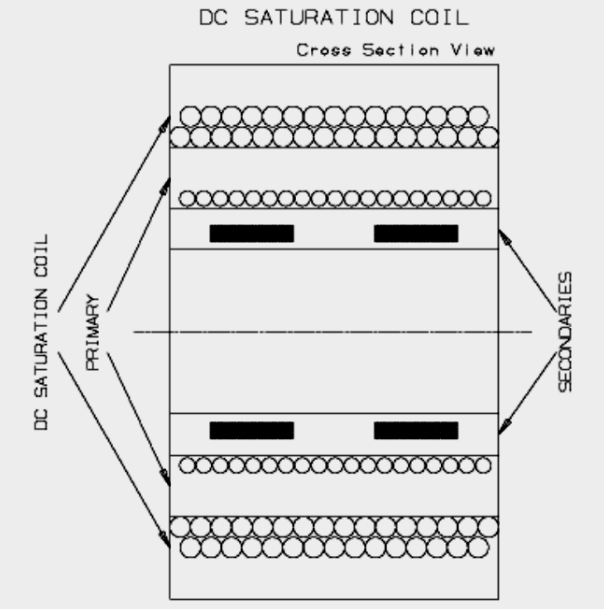

MAC's most sophisticated eddy current testers are encircling coil testers used to detect surface and subsurface flaws, including weld-line defects in materials with a uniform cross section. Encircling coil instruments operate at frequencies ranging from 1.6 kHz to 1 mHz for instruments specifically designed to inspect small-diameter wire. Typical applications for these instruments include magnetic and nonmagnetic bar, tubing, pipe, or wire. Other models provide the advantages of ultrasonic inspection at high throughput speeds for round bar and tubular products. MAC cites several advantages to leasing NDT equipment, including:

1. Selecting the best equipment for a particular application is easier.

- No obsolescence. The customer can easily upgrade to take advantage of latest advances as they occur and as needed.

- Trial leasing period is easily arranged. Selecting the most appropriate inspection equipment often requires a period of adjustment and trial. This becomes far easier with leased equipment.

- When production changes occur, equipment does not have to be scrapped. The customer can stop leasing one type of equipment and switch to leasing a different equipment that suits the new requirements. This is especially true when a production line is changed over to a different size, for example.

2. Maintaining quality control equipment in good operating order is easier.

- Service and replacement parts (except where failure is due to abuse) are provided as part of the lease. Both the lessor and lessee are eager to get the equipment repaired and up and running as soon as possible.

- Operator training and advice is available at installation and on a continuing basis, which is especially helpful when new people are assigned some time after the original installation.

3. Financing of quality control is easier.

- No large capital investment. No borrowing with accompanying interest charges is required. A company that is expanding rapidly or requires more exacting specifications can institute quality control steps without having to make a major financial commitment.

- Lease charges make up a direct current expense for tax purposes.

JOHN J. KENDRICK is senior editor of Quality.